On-line banking is integral to everybody’s life, bringing your entire financial institution to the fingertips. In accordance with a examine, RBI statistics spotlight that round 35% of the Indian inhabitants makes use of E-Banking for each day transactions, which means practically 50 crore customers are utilizing digital banking expertise each day!

Nonetheless, with excessive comfort comes an equal quantity of dangers and fraud related to digital banking. One other RBI report says that banks reported 9,102 frauds involving an underlying quantity of Rs 60,389 crore in 2022. To remain protected from banking frauds, this text talks about safety ideas for a protected digital banking expertise. Learn on to know extra.

Safety Ideas for a Protected Digital Banking Expertise

Folks can arrange their accounts in minutes, execute transactions with a PIN, have entry to the account around the clock, and ship the cash wherever merely with an identifier reminiscent of UPI- with out realizing the entire financial institution particulars. Nonetheless, additionally it is important to observe and expertise a protected digital banking expertise.

Be sure that the web site is working on HTTPS.

All of the digital banking expertise have to be carried over web sites with an ‘HTTPS’ header. HTTPS ensures that the information is shipped in an encrypted format over the web. Thus hackers sniffing information packets inside a community will obtain encrypted bits that are troublesome to decode.

Additionally, most entities, particularly banks and fee platforms, run on HTTPS. It’s now thought-about as an indication of legitimacy and belief.

Don’t use digital banking on public or shared computer systems.

Digital banking on shared computer systems can result in classes remaining invalidated or being misused when logged in. Public units have a better probability of being contaminated with malware or virus, resulting in credentials being captured by criminals. It’s suggested to not use digital banking on public or shared computer systems; we suggest cleansing your searching historical past or cookies earlier than leaving.

Utilizing digital banking functions ought to be prevented whereas linked to public WiFi.

Public WiFi spots are alluring for cybercriminals to reap credentials, particularly for banking to committing different monetary frauds. As mentioned in earlier articles, adversaries leverage public WiFi for assaults reminiscent of man-in-the-middle, sniffing, or evil twin assaults.

Transactions by way of UPI can now be finished offline fairly than connecting to a free public web supply. Numerous UPI suppliers in India allow paying with out requiring an web connection. Else, customers can carry their very own web connection in order that nobody can hook up with with out authentication.

Revise your passwords and PIN and retailer them safely.

Recurrently altering passwords and storing them in safe functions can shield your accounts. Practising password altering and implementing a strong password coverage after each three months reduces the chance of unauthorized entry.

Keep away from sharing or repeating the passwords too regularly; we advise utilizing password administration software program reminiscent of LastPass, KeePass, 1Password, and Dashlane to retailer credentials securely.

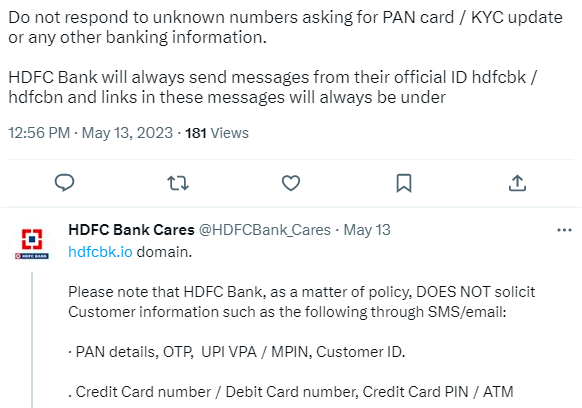

Keep conscious of the continued rip-off campaigns.

Customers should hold an lively eye on the continued rip-off campaigns relating to digital banking and transactions. Phishing, smishing, and vishing are some frequent methods adversaries attempt to get customers’ banking particulars. That is finished on a big scale earlier than it will get detected.

Open net assets reminiscent of Twitter, reddit and information channels can be utilized to trace the most recent legal actions.

Watch out for fraudulent messages and calls attempting to phish particulars from customers.

In accordance with a statistics report, roughly 3.4 billion phishing emails are despatched each day. It’s extra seemingly that if a person’s electronic mail or cellphone is current over the web, they are going to obtain a bunch of malicious URLs.

In case of phishing, it’s suggested to by no means click on on attachments despatched from unofficial domains or numbers. Confirm the sender earlier than taking any actions and search for pink flags within the message that may be distinguished from actual.

Enabling multi-factor authentication.

All digital banking actions have to be mandated to allow multi-factor authentication strategies to confirm that solely a respectable person is accessing the account. This contains safety questions, biometric fingerprints, face scans, PINs, or OTP (One-Time Password).

This ensures that even when the password is compromised, entry to the account could be restricted with one other layer of authentication.

Report safety incidents instantly.

Customers should all the time take incidents significantly. The incidents can happen personally, reminiscent of commonly checking final login dates, final login location, transaction particulars, and taking messages associated to transactions very significantly. Customers of a financial institution ought to report phishing hyperlinks to the financial institution to guard others from being a sufferer.

On a better stage, if a financial institution faces a safety incident, ensure that to alter passwords and verify for anomalies and suspicious actions within the account.

Be alert whereas scanning for QR codes or assessing fee requests.

QR codes are unreadable to people however could be processed by machines. Fraudsters can conduct phishing or transaction modulations that may ‘request’ to obtain cash beneath the disguise of sending it. Unawareness of digital transactions, particularly for individuals in rural areas, can fall sufferer to some of these ‘simple to execute’ actions.

QR codes can be changed by a fraudster’s information as a substitute of a respectable receiver or can be utilized to redirect to a malicious hyperlink that hosts malware.

Keep away from saving classes and allow session logout.

A digital banking session ought to all the time have a set interval of inactivity tracker, after which it logs out the person instantly. Additionally, an absence of invalidating the classes can result in session hijacking assaults the place an attacker can preserve persistence within the account, even with a single session token ID.

By invalidating the session after each use or an outlined interval of inactivity, delicate information reminiscent of account particulars and personally identifiable info could be protected.

In the direction of the Conclusion

As we conclude on this article about safety ideas for a protected digital banking expertise, making certain that information is protected in any respect prices is crucial. With banks coming to the customers at their fingertips, staying alert and minimizing the dangers related to on-line monetary transactions could be achieved with correct safety practices and consciousness. Hope you preferred the article; tell us what you suppose within the feedback.

Writer Bio: This text has been written by Rishika Desai, B.Tech Laptop Engineering graduate with 9.57 CGPA from Vishwakarma Institute of Info Expertise (VIIT), Pune. At the moment works as Cyber Risk Researcher at CloudSEK. She is an efficient dancer, poet and a author. Animal love engulfs her coronary heart and content material writing contains her current. You possibly can observe Rishika on Twitter at @ich_rish99.